Are there enough warning bells about Elon Musk and Tesla? Or have we forgotten Madoff, Enron, and other big-time names who were ultimately in way over their heads? For those following Tesla, it was jockeying with GM as the biggest US automaker by market capitalization, even though it sold less than 1% of the number of vehicles that GM sold, and last month, the Chevy Bolt alone outsold both the Tesla Model S and Model X combined. By being propelled to the loftiest heights based on hype, the only way left for Tesla to go is down. And many heads will roll when this gigantic house of cards Musk and Tesla has built comes tumbling down.

Now why am I so sure that Tesla has turned into a scam, a securities pyramid scheme?

Because it is doing everything it thinks it can get away with in order to keep it stock price up and get more money anywhere, any way it can.

Because the desperation of Elon Musk and Tesla is now plain as day. Desperation of failed execution (flat growth in actual sales), desperation to maintain the stock price (~$380/share at its peak, now down to about $310/share; Elon Musk has pledged his interest in Tesla as collateral for loaned funds for himself, and his creditors will surely be displeased at a precipitous stock price drop), desperation to raise additional inexpensive capital as its junk bonds dive underwater, desperation to "prove them wrong", and desperation to be loved and wanted, and to maintain his cult leader status.

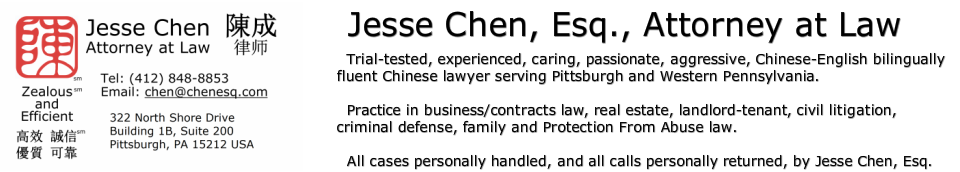

I have witnessed this scenario many times, both from public events as well as through my own practice experience. Desperate people do desperate things, and desperate things typically means cutting corners, fudging numbers, and in the case of a publicly listed and highly visible company, invariably results in a scandal that threatens its very existence.

Now why am I so sure that Tesla has turned into a scam, a securities pyramid scheme?

Because it is doing everything it thinks it can get away with in order to keep it stock price up and get more money anywhere, any way it can.

Because the desperation of Elon Musk and Tesla is now plain as day. Desperation of failed execution (flat growth in actual sales), desperation to maintain the stock price (~$380/share at its peak, now down to about $310/share; Elon Musk has pledged his interest in Tesla as collateral for loaned funds for himself, and his creditors will surely be displeased at a precipitous stock price drop), desperation to raise additional inexpensive capital as its junk bonds dive underwater, desperation to "prove them wrong", and desperation to be loved and wanted, and to maintain his cult leader status.

I have witnessed this scenario many times, both from public events as well as through my own practice experience. Desperate people do desperate things, and desperate things typically means cutting corners, fudging numbers, and in the case of a publicly listed and highly visible company, invariably results in a scandal that threatens its very existence.

Tesla Model S sedan. Image courtesy Tesla.

Tesla Model S sedan. Image courtesy Tesla. Because:

1. Tesla's sales are leveling off even as cash burn continues unabted. Recent sales have been spurred by by large discounts, even though Musk himself promised "no discounts";

2. Tesla being unable to achieve extremely important promises that it has staked its name upon because of Elon Musk being wrong. To wit:

(a) "Full self driving" sans LIDAR for which customers have put down deposits and are now suing,

(b) Musk in 2012: "Tesla does not need to ever raise another funding round",

(c) 20,000 Model 3 cars made per month by 12/2017 (Tesla is being sued for misleading investors by actually producing cars by hand due to "production bottlenecks"),

(d) Mass firing of employees under the guise of "performance reviews", apparently conducted en masse;

(e) SolarCity acquisition failing, and much more.

3. Tesla's cash burn of half a million dollars per hour means a capital raise via an equity sale and consequent dilution is inevitable in light of pending interest rate raises by the Fed, which renders another bond sale unfeasibly expensive in the face of an imminent credit downgrade;

4. Tesla is becoming increasingly defensive as well as evasive, and seeing the world in a black-and-white, us-vs.-them lens. During earnings calls, for example, its CFO avoided questions about deposit allocation, and Elon Musk himself actually saying "shut the f---- up" in response to Toyota's solid state battery technology claims (rather reminiscent of Enron's "asshole" earnings call comment made when asked about why it was "the only financial institution that can't come up with balance sheet or cash flow statement after earnings", shortly before Enron imploded);

5. After "revealing" the first 30 Model 3 "deliveries" to employees who are subject to gag contracts and the subsequent failure to deliver on its production and sales promises, and realizing the major problems it now faces Tesla and Musk have quickly scheduled another "reveal" that would "blow your mind clear out of your skull and into an alternate dimension". The more joking hyperbole Elon Musk and Tesla spits (psychological "reappraisement" in order to cope with horrific reality), the more it reveals Tesla's true position --Tesla is teetering on the brink of collapse --

1. Tesla's sales are leveling off even as cash burn continues unabted. Recent sales have been spurred by by large discounts, even though Musk himself promised "no discounts";

2. Tesla being unable to achieve extremely important promises that it has staked its name upon because of Elon Musk being wrong. To wit:

(a) "Full self driving" sans LIDAR for which customers have put down deposits and are now suing,

(b) Musk in 2012: "Tesla does not need to ever raise another funding round",

(c) 20,000 Model 3 cars made per month by 12/2017 (Tesla is being sued for misleading investors by actually producing cars by hand due to "production bottlenecks"),

(d) Mass firing of employees under the guise of "performance reviews", apparently conducted en masse;

(e) SolarCity acquisition failing, and much more.

3. Tesla's cash burn of half a million dollars per hour means a capital raise via an equity sale and consequent dilution is inevitable in light of pending interest rate raises by the Fed, which renders another bond sale unfeasibly expensive in the face of an imminent credit downgrade;

4. Tesla is becoming increasingly defensive as well as evasive, and seeing the world in a black-and-white, us-vs.-them lens. During earnings calls, for example, its CFO avoided questions about deposit allocation, and Elon Musk himself actually saying "shut the f---- up" in response to Toyota's solid state battery technology claims (rather reminiscent of Enron's "asshole" earnings call comment made when asked about why it was "the only financial institution that can't come up with balance sheet or cash flow statement after earnings", shortly before Enron imploded);

5. After "revealing" the first 30 Model 3 "deliveries" to employees who are subject to gag contracts and the subsequent failure to deliver on its production and sales promises, and realizing the major problems it now faces Tesla and Musk have quickly scheduled another "reveal" that would "blow your mind clear out of your skull and into an alternate dimension". The more joking hyperbole Elon Musk and Tesla spits (psychological "reappraisement" in order to cope with horrific reality), the more it reveals Tesla's true position --Tesla is teetering on the brink of collapse --

| The Tesla Roadster 2.0: - Pay $50,000 or the full $250,000 right now to reserve a concept car years from production... - ...with a claimed 200 kWh battery when a 100 kWh battery wouldn't even fit on a Model 3... - ...cannibalizing Model S sales... - ...and arriving at an indefinite future time after a slew of major established competitors' cars are near or on the market (in no particular order): * Porsche Mission E. * BMW i8. * Audi e-tron. * Aston-Martin rapidE. * Renault Trezor. * Mercedes Maybach-6. * And even an electric supercar from a Chinese automaker: the NIO EP9. Tesla has no moat. Except for its brand name, Tesla has no specialized technology or capabilities that is not available to other, better capitalized and financed, and less abrasive, offensive companies who feud with critical suppliers and throw suppliers under the bus when expedient (but neglecting to acknowledge its own shortcomings, such as with... welding... and making batteries). The actions of insiders, executives (such as the CFO's abrupt resignation and chiefs of self-driving technology), and engineers in the know do not square with the outlandish public claims of the company and CEO Elon Musk. So the latest "reveal" of the Semi and the Roadster 2.0 is nothing more than an attempt at hype, to get more money through cash deposits (fund current cash burn by pledging future profits) rather than issuing more stock or selling bonds in order to fund an enterprise with an unsustainably high cash burn rate. Kind of like a... pyramid scheme. Kind of like when Bernie Madoff kept trying to raise money even at the very end. | The Tesla Semi: - Musk's numbers of 300/500 miles range per charge and $150/180k per Semi are fantastic -- important numbers, including battery type and weight, cost, charging infrastructure, capital investment involved, etc. are all left out -- and fantastic in the sense that none of these add up. - The windshield can withstand a "thermonuclear explosion". - No mirrors, 2 screens. Imagine driving this semi at night, or trying to poke at the screens during rush hour traffic, etc. - Bait and switch: $5,000 deposit suddenly turns into a $20,000 deposit per Semi. Or, if you'd prefer, the full $250,000 for a "Founders Series" Semi Kickstarter Project today, to be delivered sometime in the future... - ...a future where Tesla has installed "Megachargers" and making money charging $0.07 per kWh to Semi customers from large solar-powered truck stops. Somehow, without mentioning anything about capital raises. |

RSS Feed

RSS Feed